Argentina: a brief summary in charts, a hopeful rebirth opens up

President elect Milei and his team have a real opportunity to rekindle Argentina and steer it on a long term development path again. Their public support is strong (56% voted for Milei against 44% for incumbent Peronist candidate Massa), the fiscal and monetary mess they inherit is manageable and, with some luck, the energy and agricultural sectors could be strong bases upon which to rely in the short term – Mercado Libre mentality and entrepreneurship will be essential in a renewed successful long term growth path -.

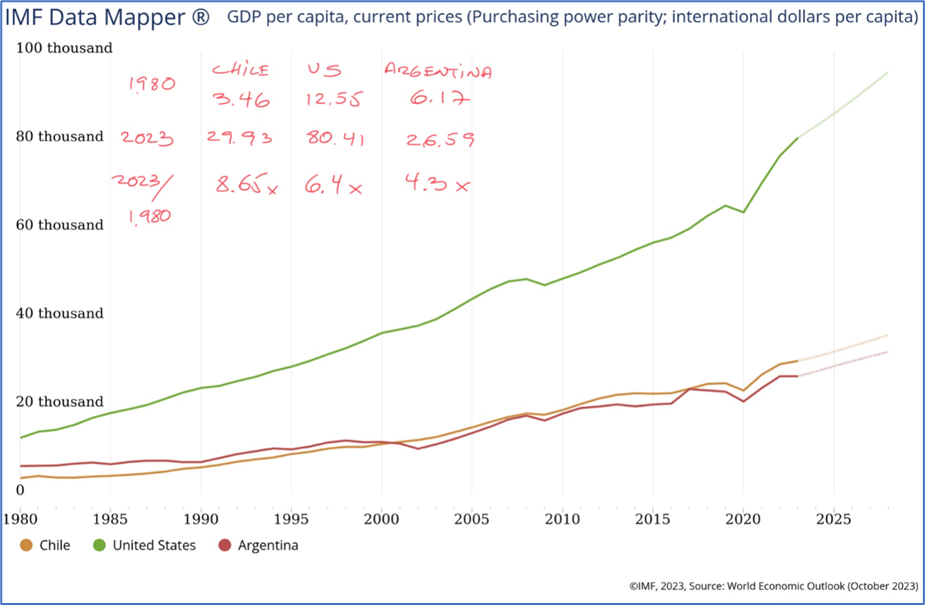

- A relative loss in Argentinian GDP per capita for over four decades … (IMF Data Mapper).

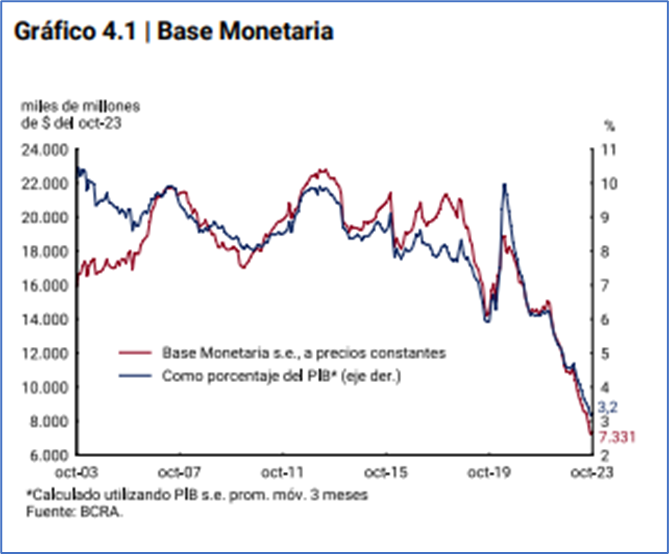

- At 143% annual inflation in October, its monetary base (currency in circulation plus reserve balances) has fallen from a historic 8 to 10% of GDP range to 3% of it. Inflation tax memoirs … (Informe Monetario Mensual, octubre 2023, Banco Central de la República Argentina).

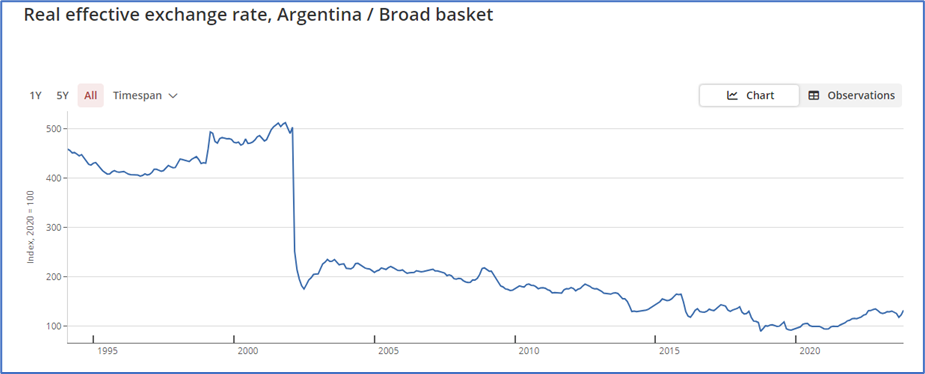

- In two decades, Argentinian real exchange rate – nominal exchange rate against a broad basket of foreign currencies, corrected for relative inflation – has fallen around 75%, clearly too excessive a discount if it returns to efficient and competitive policies … (Bank for International Settlements, BIS).

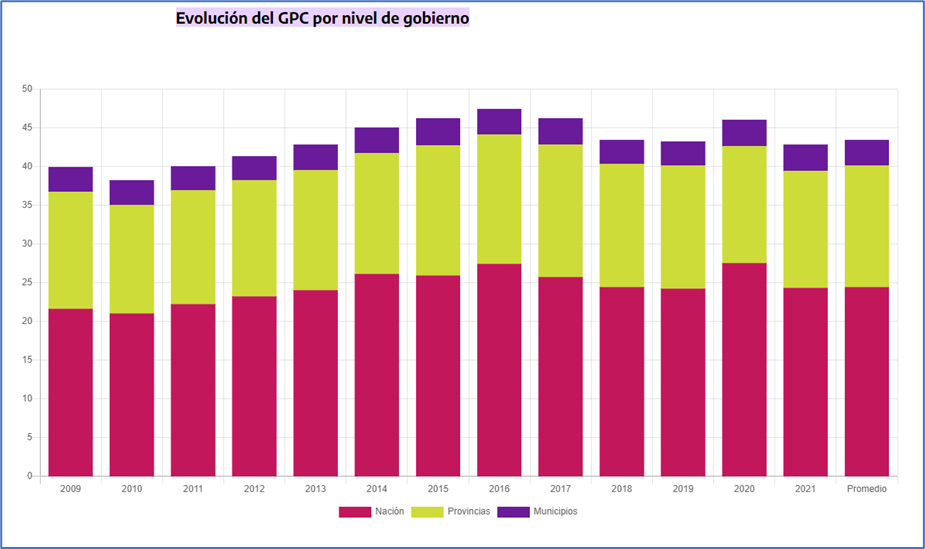

- A difficult to dislodge interest groups network: between 2009 and 2021, central government expenditures represented an average of 24.4% of GDP; provincial governments, 15.7%; local governments, 3.3%. In total, 43.3% of GDP: decreasing its aggregate weight over GDP will be a challenging task. Profiles in courage needed after long decades with ever increasing government dependency promotion … (Informe Gasto Público Consolidado, 2009 – 2021, Ministerio de Economía, Argentina).

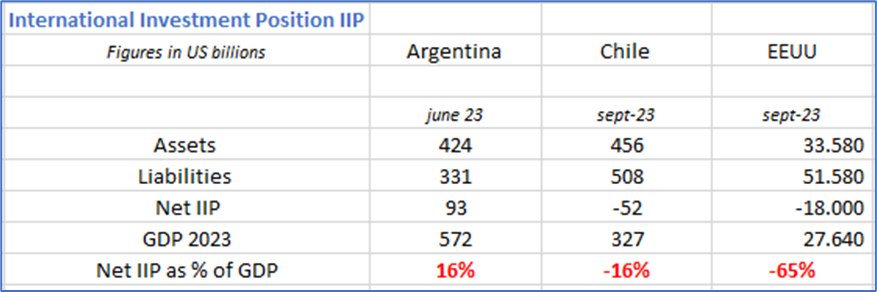

- Contrary to common knowledge, Argentina is a net creditor to the world, with more international assets than liabilities, as opposed to being a net debtor to the world, such as the United States, which keeps a remarkably high 65% of GDP net debt position owed to foreigners. No other country in the world could afford this deeply indebted position for a long time without being forced to rebalance – and sooner rather than later it will happen -, but Argentina, against all odds, is on the other side, the creditor side … (US Bureau of Economic Analysis, Banco Central de Chile, BCRA).

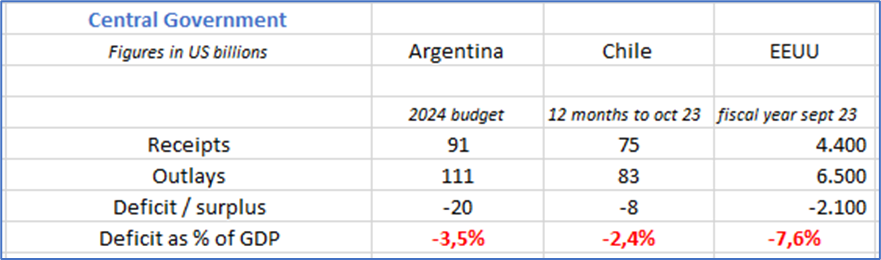

- Argentina is expected to have a US$ 20 billion central government deficit, equivalent to 3.5% of GDP, in 2024. Even if government expenditures were more difficult to slash and/or activity were to be more negatively affected due to anti-inflationary short term economic policies, this deficit is manageable and represents half the US Federal Government deficit to GDP… (US Treasury, DIPRES, Ministerio de Economía Argentina).

- There is a recurring remark – and perhaps confusing – referred to Argentinian Central Bank short term debt in PASES (one day) and LELIQ´s (28 days), amounting to over a $ Arg 24.000 million stock paying between 126% and 133% in annual terms, whose annual payment – and corresponding deficit – would be equivalent to 10% of GDP. However, after a current 143% annual inflation rate, that debt has no real cost at present conditions. It is just another inflationary mirage. The effective deficit, the 3.5% of GDP projected for year 2024, is centered on the difference between receipts and outlays at the central government level, after correcting for inflation … (Informe Monetario Mensual, octubre 2023, Banco Central de la República Argentina).

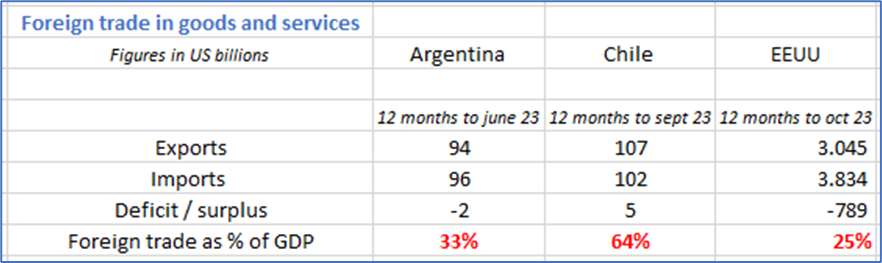

- In terms of foreign trade openness, Chile leads both the US and Argentina: 64% of GDP compared to 25 and 33%, respectively. The former one has a strong domestic market, big enough to rely on; the later one, a history of failing import substitution policies proven difficult to eradicate. Leaving MERCOSUR and liberalizing foreign trade would be the best policy in decades.

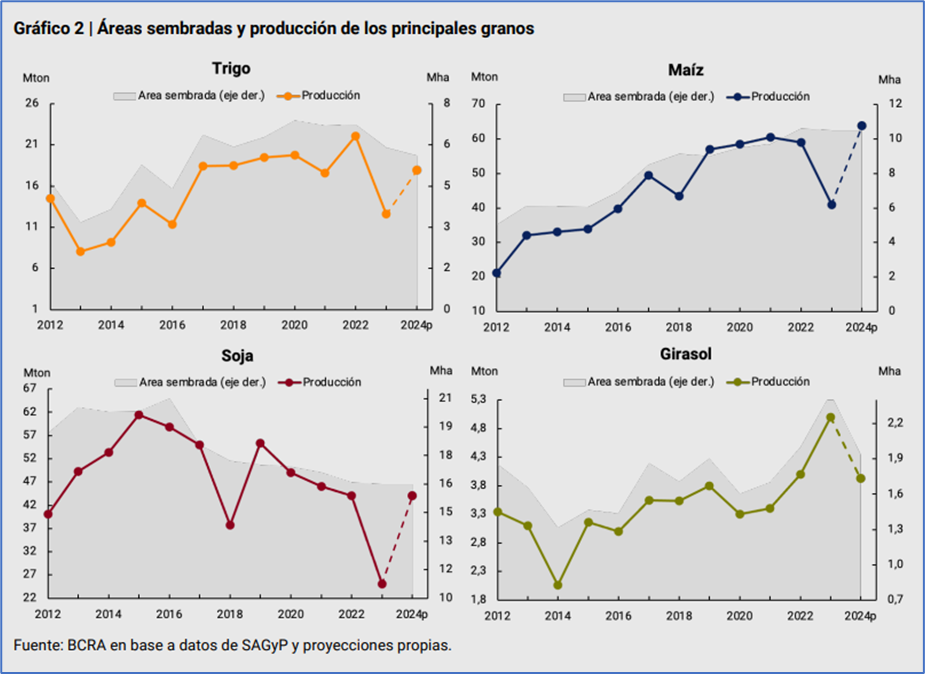

- Favorable winds in the grain sector: projected harvest could be around 130 million tons this current 2023 – 2024 season, up 40 million tons from the previous one, badly damaged by a El Niño related drought. Going back to agricultural exports around US$ 35 billion, or close to US$ 20 billion more than last season, would be well received in needy times … (Informe de Política Monetaria, octubre 2023, Banco Central de la República Argentina).

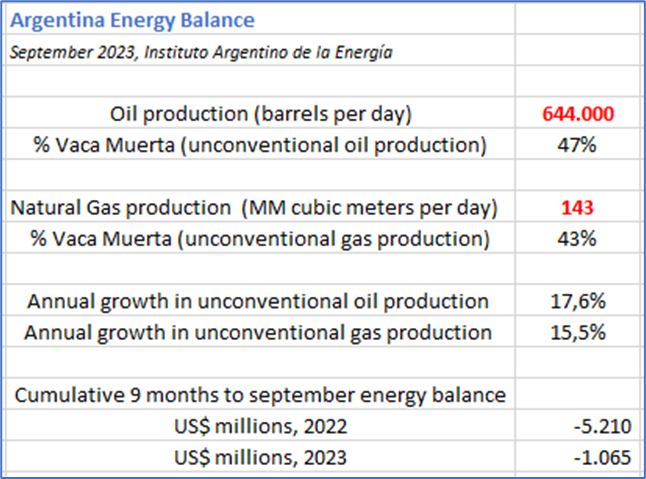

- Argentina is on path to becoming a net energy exporter, supported by newly developed Vaca Muerta shale and tight oil and natural gas reserves. Chile might be on that path, too, based on renewable energy, but it will take more time. Both countries would be greatly benefited with a more integrated electricity grid – inter country oil and gas pipelines already exist -, with the precaution of not depending only on each other, given Argentinian natural gas provision breach of contracts in mid 2000´s …

In summary, the new government faces a demanding 143% annual hyperinflation originated in chronic fiscal deficit years being financed via issuing money from the Central Bank. But that cause is no longer the case and fiscal expenditures are soon to be capped to balance the budget. A credible decision to open Argentina to foreign trade, to dismiss up front the temptation to finance fiscal deficits with monetary issuance and controlling the level and efficiency of fiscal expenditures, aided by a revamped agricultural sector and Vaca Muerta consolidation, do grant good odds for success.

In absolute terms, the fiscal deficit is perfectly manageable. Given inflationary numbers, Argentina already works in dollar terms – we saw how Argentinian peso monetary base was already greatly reduced -, and even a future dollarization might not be needed, once inflation is subdued. And Argentina has not only a lot of resources in foreign lands, but also much better perspectives in terms of foreign trade flows in the near term.

In the past, the Argentinian discount might have been well deserved, and more so during the Kircher Fernández years. If president elect Milei, his ministers and coalition are able to structurally change their country towards an open and more efficient policy-wise environment, the real revaluation of its currency might turn out to be impressive. What should not happen is trying to move halfway, because that is a recipe for certain failure.

To be or not to be …

Manuel Cruzat Valdés

December 7th, 2023