Lithium in Chile, IRA in the United States and State of the Union in the European Union

At last, this past September 4th 62% of Chilean voters strongly rejected a new Constitution proposal that intended to profoundly redefine this country into numerous nations, different judicial systems, with a broken one person – one vote equality, an unchecked power distribution in favor of the executive and legislative branches that would have given them oversight of the new judiciary structure and, to make matters worse, deliberately weakening property rights. As it was, it would have condemned Chile to a deep and lengthy social and economic crisis, and even possibly, to a populist dictatorship as we have long witnessed in Latin America.

Voters were much wiser across all ages, gender, income levels and geography. A new Constitution will come into scene at some time, but the strong message for moderation and respect of Chilean history, institutions and values was clear, notwithstanding the still lingering denialism from some government officials and parliamentarians.

It is now time to start looking into our future with optimism. The world energy transition process already in motion, no matter how long it takes, will structurally benefit this until now net energy importer country which is rich in copper (26% of world mined copper production), sun (best worldwide solar irradiation) and lithium. We cannot make mistakes.

Some elements have to be taken into account:

- Russia (US$ 1.7 trillion GDP, 7% of US GDP, net energy exporter) and China (US$ 17 trillion GDP, 74% of US GDP, net energy importer) are actively challenging western world order, with arms if necessary. Ukraine invasion by Russia since February 2022 and naval encirclement exercises around Taiwan by China in August 2022 are just the latest examples.

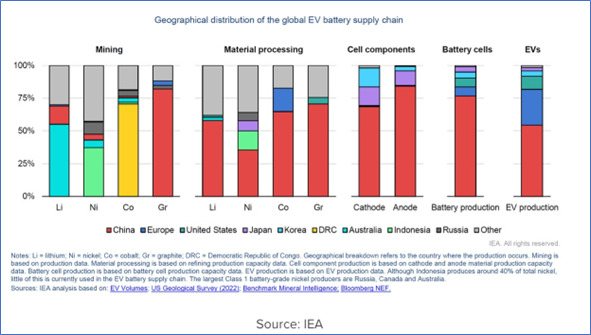

- On September 14th, 2022 European Commission President von der Leyen (EU 27 US$ 17 trillion GDP, 74% of US GDP, net energy importer) declared that[1] “Whether we talk about chips for virtual reality or cells for solar panels, the twin transitions will be fuelled by raw materials. Lithium and rare earths are already replacing gas and oil at the heart of our economy. By 2030, our demand for those rare earth metals will increase fivefold. And this is a good sign, because it shows that our European Green Deal is moving fast. The not so good news is – one country dominates the market. So we have to avoid falling into the same dependency as with oil and gas. This is where our trade policy comes into play … We need to update our links to reliable countries and key growth regions. And for this reason, I intend to put forward for ratification the agreements with Chile, Mexico and New Zealand … Today, China controls the global processing industry. Almost 90% of rare earths and 60% of lithium are processed in China. We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European Critical Raw Materials Act…”

- President Biden signed the Inflation Reduction Act into law on August 16th, 2022. Among other things, it makes available federal income tax credits up to US$ 7.500 for electric vehicles, distributed into a US$ 3.750 tax credit associated to a critical mineral requirement and the remaining US$ 3.750 tax credit dependent on a battery component requirement. The objective is to have increasing percentages of the value of components contained in the battery to be manufactured or assembled in North America (50% in 2023, going up to 100% in 2029) and increasing percentages of the critical mineral components of the electric vehicle battery to be extracted or processed in the United States, in a country with which the US has a free trade agreement in effect – US/Chile FTA in force since 2004 – or recycled in North America (40% in 2023, going up to 80% in 2027). Lithium is one of those critical minerals. Additionally, to be eligible to these tax credits, the electric vehicle may not contain any of the critical minerals nor any battery components manufactured or assembled by a foreign entity of concern. It so happens that one kind of this entity of concern is defined as “owned by, controlled by, or subject to the jurisdiction of a government of a foreign country that is a covered nation (as defined in section 2533c of title 10)”. Title 10 of U.S. Code refers to Prohibition on Acquisition of sensitive materials from non-allied foreign nations. As of today, China, Russia, Iran and North Korea are deemed such nations.

- In the Chilean case, Tianqi, a Chinese company that owns 23% of SQM, which itself has a contract with a state owned company CORFO until 2030 to extract lithium to the order of 180.000 tons of LCE (lithium carbonate) annually from Salar de Atacama, qualifies as a “foreign entity of concern”. The American company Albemarle, which has an equivalent contract with CORFO to extract lithium to the tune of 85.000 tons of LCE per year until the end of 2043, has also a Joint Venture Agreement with the already mentioned Tianqi in Talison, Australia. Lithium market in 2021 reached 500.000 tons of LCE.

- Any attempt by Tianqi to control SQM or share control with other shareholders would automatically make lithium extracted by the last one non eligible to US federal tax credits, because SQM would then be given the same “foreign entity of concern” classification, to the detriment of royalties paid to CORFO dependent on sales prices. It would not be surprising if the EU were to follow a similar policy under its own Critical Raw Materials Act.

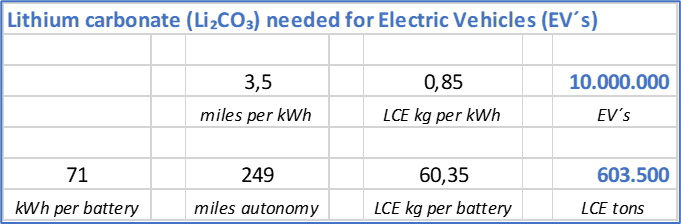

- Lithium supply will be extremely stressed in the short term. A simple estimation might help to ascertain a base case:

In other words, 10 million EV´s, which might be reached this year 2022 or next, will need close to 600.000 tons of LCE. By 2030, projections are for 40 million EV´s, representing close to 40% of new vehicle sales worldwide …

Going back to Chile, what is in our best interest, given a constitutional process expected to be well headed and oriented this time?

For starters, ratify the updated EU – Chile Association Agreement, in place since November 2002, before the end of 2022. Chile is a free trading country and remains committed to be so.

At the same time, ratify de Transpacific TPP11 Trade Agreement, which involves the same countries with which Chile has free trade agreements but which additionally eases commercial flows, assuming investor protections remain essential. In this treaty neither the US nor China or the EU participate.

As for Salar de Atacama lithium potential, prepare for an ambitious bidding process due 2025, taking effect at the end of 2030, when present contract with SQM ends. In this process, as long as US and EU policies remain as expected, no “foreign entity of concern” will be able to participate and royalties and technology transfers will be highly valued.

If pressed to choose sides, Chile will keep its deep western world nature. As a policy, it will allow selling minerals to anyone interested on them, while trying to avoid dependencies such as Europe´s energy sector with Russia that are clearly not in our national interest. In the copper case, the same principle will apply.

If for some unexplainable reason our present government keeps delaying these treaty ratifications, we will have to correct those mistakes under a new government in 2026. Voters have already talked.

Manuel Cruzat Valdés September 23rd, 2022

[1] 2022 State of the Union Address by President von der Leyen, European Commission, Strasbourg, 14 September 2022