Energy prices: what if fracking did not exist?

The despicable invasion of Ukraine by Russia has naturally stressed energy markets. But the situation would be far more extreme if the US had not previously developed the fracking revolution, a revolution that transformed the US into the biggest energy producing country in the world within a decade and an incipient net exporter of it.

Since 2019 the US is a net energy exporter (1% surplus). In early 2000´s the US imported 30% of its energy needs from foreign producers, while representing 24% of world energy consumption. As of today, the US basically consumes the same amount of energy of two decades ago, representing 16% of it, but with a GDP 50% bigger in real terms.

China, which in 2000 represented 11% of world energy consumption, today consumes 26% of it. Furthermore, China consumes 54% of world coal. In terms of economic weight, China is today the biggest net energy importer in the world, centered on its oil imports – it imports 10 million barrels per day out of 14 million barrels per day of consumption – and natural gas imports – it imports 140 bcm out of 330 bcm annual consumption -. And it also is its biggest polluter: 31% of world CO2 emissions; US, 14%.

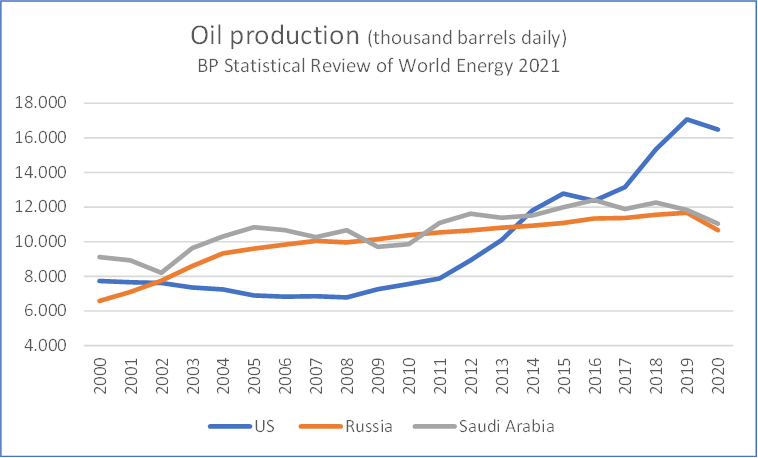

While Russia and Saudi Arabia oil production remained pretty flat around 11 million barrels per day in the 2010´s, the US more than doubled its production from 7 million barrels of oil per day in the 2000´s, reaching 19% of world oil production at the end of the period.

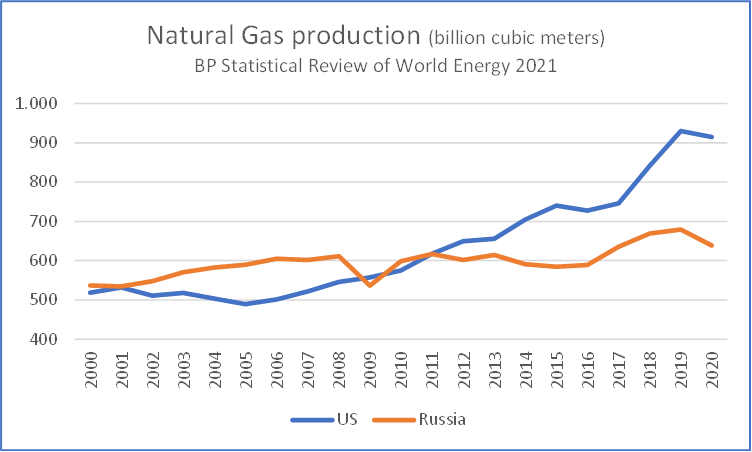

While Russia annually produced around 600 billion cubic meters (bcm) on a stable basis, the US production jumped from 500 bcm per year in early 2000´s to over 900 bcm at the end of the two decade period, representing now 24% of world natural gas production.

Over 70% of world oil consumption is explained by transportation demand. As this last one gets gradually electrified, oil needs will dramatically decrease. But in the very short term, the TESLA´s of the world will not be massive enough to represent a quantitative impact on oil consumption. However, they certainly will as they revolutionize the transportation world within this present decade.

Electrification in the transportation sector and lower cost from renewables will condemn first oil and gradually natural gas, an efficient and useful back up in today´s electricity systems. Coal presence will essentially depend on China´s decision to clean itself. It all is a simple consequence of costs.

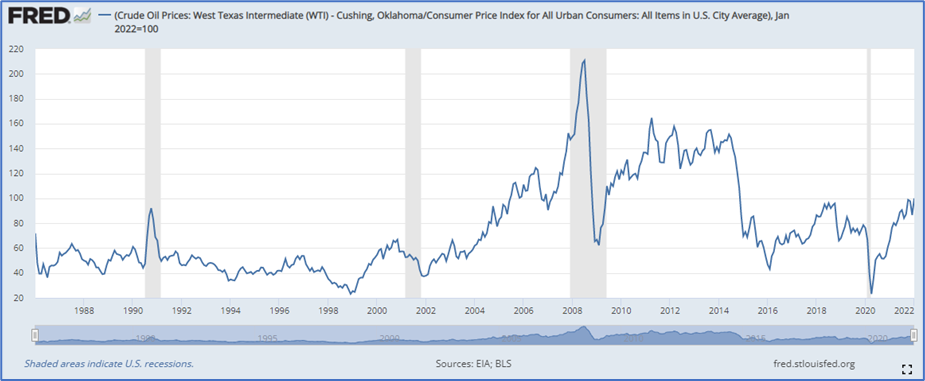

Today´s Russian aggression and world disruption have caused a huge spike in oil and natural gas prices. But just remember that the oil shock we are witnessing is causing – at the moment – nearly half its impact it did have in 2008, before the financial crisis, as measured in real terms.

In other words, let us give thanks to fracking and seriously allow it to expand overseas from the US. Unreasonable political opposition only weakens the US and the world and strengthens regimes such as Russia and Iran.

US fracking revolution was a resounding strategic success, led from the private sector. It defies common sense weakening it. In the short term we, world consumers, need its further expansion where shale resources and pipelines do exist, Europe included; in the longer term, lower cost renewables will inevitably displace it.

The first executive act from present US administration was to cancel Keystone oil pipeline. Well, it might be worthwhile to take an example from Germany´s new chancellor, with his decision to rearm his army and allow alternatives to natural gas from Russia, unheard of prior this Russian aggression.

Start reversing Keystone pipeline opposition and fracking in federal lands. A bitter pill for some, but a blessing for most. Signal this and a new equilibrium will start taking place. Renewables will keep coming, but under a healthy competitive transition.

Manuel Cruzat Valdés

March 7th, 2022